About Taxforms

- Software: If your software has a tax form module, you're ready to use Microsoft Business Checks tax forms. Be sure to check if your software prints one-wide or two-wide forms. Not sure? Just give us a call for expert assistance. Don't have a tax form module with your software? Try our tax preparation software. It's a simple solution for processing W-2s and 1099s that can save you time - and money! See our Product Catalog for further details. Printer: We offer tax forms for both continuous and laser printers.

- Number of parts: As you order, Microsoft Business Checks will provide you with the number of parts you'll need based on your individual state's requirements. You may want to order additional parts to suit your accounting methods. Want to know more? Click here to find out about your State Tax Forms Requirements

- Tax Regulations: Our online ordering process is specially set up to offer tax form recommendations based on individual state requirements. If you'd like more in-depth information about tax forms and regulations, use this link to the IRS web site

Here's all you need to know about the forms you need to match your state's tax form requirements, as well as how each copy is filed.

Our online ordering system automatically makes a recommendation for tax forms (based on the information below) as you order! It doesn't get any easier!

| State Requirements | |||

| State | Mag Media Lieu of State Copy |

# of Parts Required | |

| Form W-2 | Form 1099-Misc | ||

| Alabama * | 6 | 4 | |

| Alaska | 4 | 3 | |

| Arizona | 6 | 4 | |

| Arkansas | 6 | 4 | |

| California | 6 | 4 | |

| Colorado | 6 | 4 | |

| Connecticut | 6 | 4 | |

| Delaware * | 6 | 4 | |

| D.C. | 6 | 4 | |

| Florida | 4 | 3 | |

| Georgia | 6 | 4 | |

| Hawaii | 6 | 4 | |

| Idaho | 6 | 4 | |

| Illinois | 6 | 4 | |

| Indiana | 6 | 4 | |

| Iowa | 6 | 4 | |

| Kansas | 6 | 4 | |

| Kentucky * | 6 | 4 | |

| Louisiana | 6 | 4 | |

| Maine | 6 | 4 | |

| Maryland | 6 | 4 | |

| Massachusetts | 6 | 4 | |

| Michigan * | 6 | 4 | |

| Minnesota | 6 | 4 | |

| Mississippi | 6 | 4 | |

| Missouri * | 6 | 4 | |

| Montana | 6 | 4 | |

| Nebraska | 6 | 4 | |

| Nevada | 4 | 3 | |

| New Hampshire | 4 | 3 | |

| New Jersey | 6 | 4 | |

| New Mexico | 6 | 4 | |

| New York * | 6 | 4 | |

| North Carolina | 6 | 4 | |

| North Dakota | 6 | 4 | |

| Ohio * | 6 | 4 | |

| Oklahoma | 6 | 4 | |

| Oregon | 6 | 4 | |

| Pennsylvania * | 6 | 3 | |

| Rhode Island | 6 | 4 | |

| South Carolina | 6 | 4 | |

| South Dakota | 4 | 3 | |

| Tennessee | 4 | 3 | |

| Texas | 4 | 3 | |

| Utah | 6 | 4 | |

| Vermont | 6 | 4 | |

| Virginia | 6 | 4 | |

| Washington | 4 | 3 | |

| West Virginia | 6 | 3 | |

| Wisconsin | 6 | 4 | |

| Wyoming | 4 | 3 | |

The grid below explains the purpose of each part. Microsoft Business Checks will recommend the number of parts based on your individual state's requirements, or you can check the State Requirement grid above. Note: you may wish to order additional parts for easier recordkeeping.

Copy A - Filed with Payer's Federal Tax Return

Copy B - Filed with Recipient's Federal Tax Return

Copy C - Filed with Recipient's Federal Tax Return

Copy 1 - Filed with Recipient's State Tax Return (or extra copy)

Copy 2 - For Recipient's State Record

| Form 1099-Misc Number of Parts per Set | ||||

| 3-Part | 4-Part | 5-Part | ||

| Part 1 Copy A Part 2 Copy B Part 3 Copy C |

Part 1 Copy A Part 2 Copy B Part 3 Copy C Part 4 Copy 1 |

Part 1 Copy A Part 2 Copy B Part 3 Copy C Part 4 Copy 1 Part 5 Copy 2 |

||

The grid below explains the purpose of each part. Microsoft Business Checks will recommend the number of parts based on your individual state's requirements, or you can check the State Requirement grid above. Note: you may wish to order additional parts for easier recordkeeping.

Copy A - Federal IRS Copy

Copy 1 - Filed with Employer's State/City or Local Tax Return

Copy B - Filed with Employee's Federal Tax Return

Copy C - For Employee's Personal File

Copy 2 - Filed with Employee's State/City or Local Tax Return

Copy D - For the Employer's Record (Also may be used as an extra

Copy 1)

| Form W-2 Number of Parts per Set | ||||||

| 4-Part | 6-Part | 8-Part | ||||

| Part 1 Copy A Part 2 Copy B Part 3 Copy C Part 4 Copy D |

Part 1 Copy A Part 2 Copy 1 Part 3 Copy B Part 4 Copy C Part 5 Copy 2 Part 6 Copy D |

Part 1 Copy A Part 2 Copy 1 Part 3 Copy 1 Part 4 Copy B |

Part 5 Copy C Part 6 Copy 2 Part 7 Copy 2 Part 8 Copy D |

|||

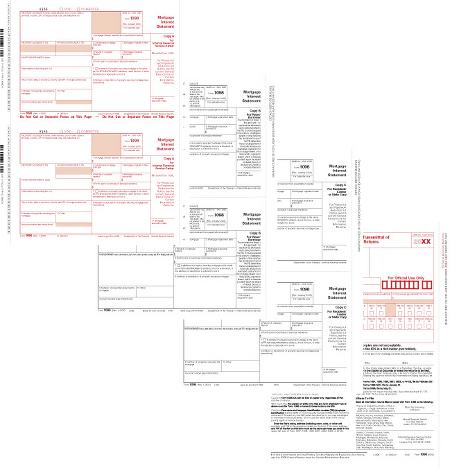

If you plan to file 250 or more Forms W-2, 1099, 104S, 5498, 6248, or W-2G, Federal copy A must be filed on magnetic media. That means you'll also need paper forms for those parts of a W-2 or 1099, which will be sent to the employee or payee. We can help! Our most popular magnetic media self-mailers feature a cover sheet which acts as an employer file or state copy. Inside the envelope are 3 or 4-inserts which act as the employee copies.